Columbia Credit Union

Where you bank matters.

Remember that Columbia Credit Union is your local not-for-profit financial institution. Your money here flows right back into the community to offer lower loan rates, high-yield deposits, and widespread donation dollars.

It’s good for you and our neighbors, too.

OVERDRAFT KINDNESS

Overdrafts happen.

Our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. Account go negative? Avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30pm on the day of that overdraft.

VISA Credit Cards

With low rates, high rewards, and global travel benefits—there’s a Columbia CU credit card for everyone.

INCOME CHECKING

Free checking that pays.

MORTGAGE LENDING

Home loans made easy.

MORTGAGE LENDING

Home loans made easy.

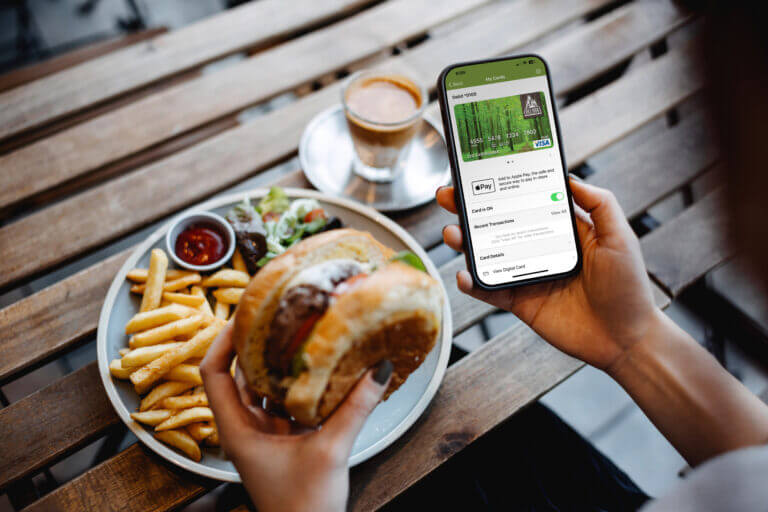

CARD MANAGER

Get better card controls, features, and convenience.

Controlling, tracking, and protecting your cards is easy with Card Manager. Manage your Columbia CU debit and credit cards through Online Banking or the Columbia CU app.

Here’s a taste of what Card Manager allows you to do:

- Lock/unlock debit and credit cards

- Set travel plans so you don’t have to worry about your card declining

- Easily add cards to your mobile wallet like Apple Pay or Google Pay

- Report lost or stolen cards

- View subscriptions and websites with your card on file

Find Card Manager under “Additional Services” in Online Banking on your desktop or under “More” in the Columbia CU app to check it out.

Get better card controls, features, and convenience.

Controlling, tracking, and protecting your cards is easy with Card Manager. Manage your Columbia CU debit and credit cards through Online Banking or the Columbia CU app.

Here’s a taste of what Card Manager allows you to do:

- Lock/unlock debit and credit cards

- Set travel plans so you don’t have to worry about your card declining

- Easily add cards to your mobile wallet like Apple Pay or Google Pay

- Report lost or stolen cards

- View subscriptions and websites with your card on file

Find Card Manager under “Additional Services” in Online Banking on your desktop or under “More” in the Columbia CU app to check it out.

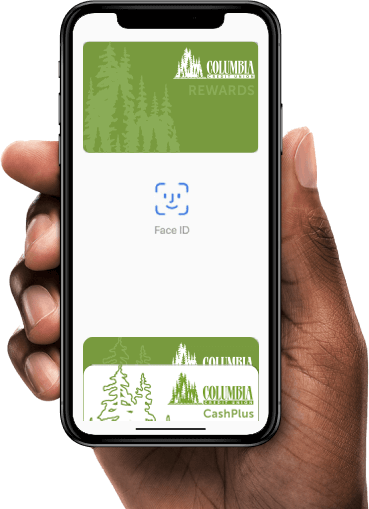

VISA IN YOUR MOBILE WALLET

Accepted everywhere,

all the time.

Add your Columbia Credit Union VISA credit card to your Mobile Wallet to make no-contact purchases, pay bills through Online Banking, and get emergency cash when you need it most.

$100 FOR YOU! $100 FOR THEM!

Refer a Friend for $100

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

$100 FOR YOU! $100 FOR THEM!

Refer a Friend for $100

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

WHAT LOCAL MEMBERS ARE SAYING

"They're all about changing their members' lives, and their communities' lives. And that's what they're going to do for you."

Susan Peake, Columbia CU Member

WHAT LOCAL MEMBERS ARE SAYING

"They're all about changing their members' lives, and their communities' lives. And that's what they're going to do for you."

Susan Peake, Columbia CU Member

Don't just take it from us.

-

Best of Clark County

Award 2008 – 2023The Columbian

-

Corporate Philanthropy

Award 2017 – 2023Portland Business Journal

-

Best in Business

Award 2013 – 2023Vancouver Business Journal

¹APY=Annual Percentage Yield and is accurate as of July 10, 2023 and can change at any time without notice. Minimum to open is $1. To earn Rewards APY, you must meet each of the following Requirements during the period of the 26th of the prior month to the 25th of the current month: 1) Enrolled in e-Statements by 11:59 p.m. PT; 2) Have a direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: A posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

²APR=Annual Percentage Rate and is accurate as of April 11, 2024. APRs range from 6.49% to 15.49%. The APR you qualify for is based on repayment period, your vehicle’s value, year and mileage and your credit qualifications including residential status, credit and employment history. Payment example: If you borrow $20,000 for 60 months at 6.49% APR, your monthly payment would be $391.23. If you’re refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying APR or; b) up to 1.00% APR off your current lender’s APR down to our floor of 4.99% APR. Membership required to borrow. Columbia Credit Union may offer other rates in the future.