Join the credit union movement.

Lindsey Salvestrin, our President & CEO, joined branch leader Julie Bocanegra on Hello Rose City to discuss the credit union movement and all the benefits of being a member at a place that puts members first:

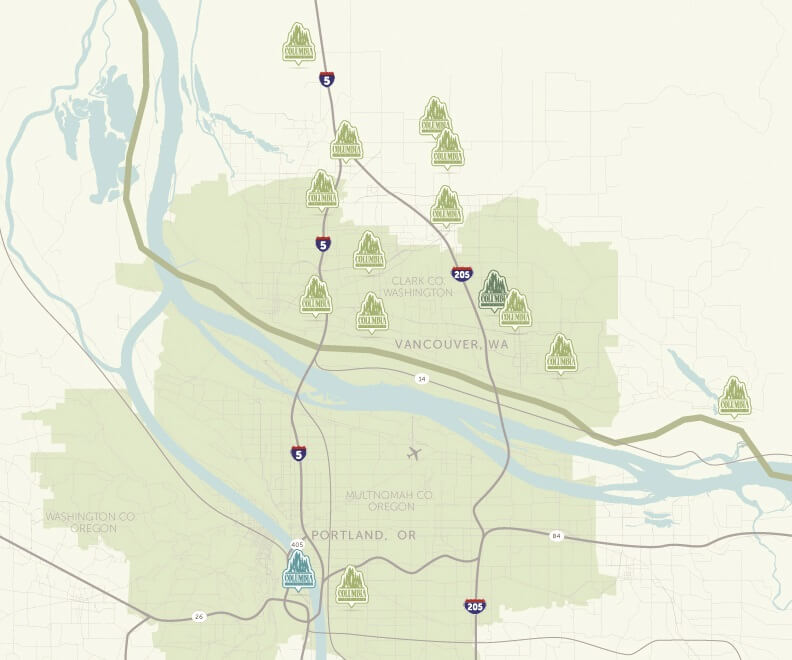

- How money stays in the community

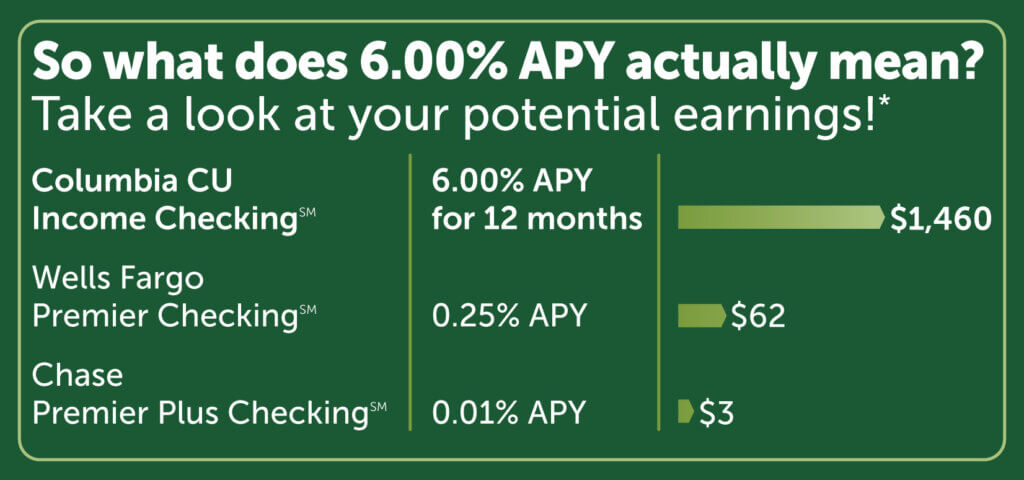

- Why credit unions can offer better rates

- What local service brings to members