REWARDSPLUS CHECKING

Get free checking plus all the perks

Unlock exclusive perks and savings tailored just for you.

Unlock exclusive perks and savings tailored just for you.

Unlock exclusive perks and savings tailored just for you.

Open an account and enjoy our early direct deposit to get your money up to three days early.1

Open an account and enjoy our early direct deposit to get your money up to three days early.1

Say goodbye to monthly fees and hello to more savings.

One dollar is all it takes to embark on a financial growth journey.

The NCUA provides up to $250k in account insurance.

Discover the incredible perks and advantages that await you when you open a RewardsPlus Checking Account at Columbia Credit Union:

Discover the incredible perks and advantages that await you when you open a RewardsPlus Checking Account at Columbia Credit Union:

Our Card Manager feature in Online & Mobile Banking helps secure your cards while you’re away from home.

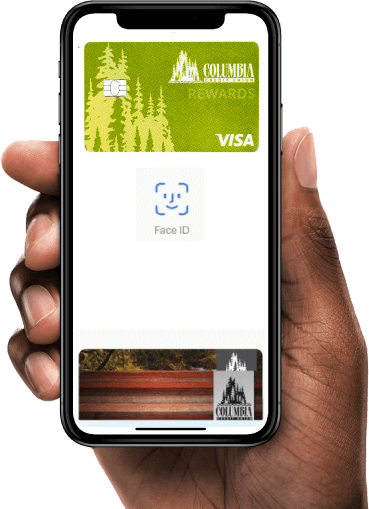

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

★★★★★

Simply open the Apple Pay, Google Pay, or Samsung Pay app on your device and follow the prompts to add your card. You must enter your card information and verify it with Columbia Credit Union. You can then start making purchases in stores and within apps without swiping your cards or entering payment and contact information.

Yes, you can personalize your Columbia Credit Union debit card by uploading a one-of-a-kind image through the Custom Card Image feature in Online and Mobile Banking, free of charge. To do so, log in to your account, navigate to the card customization option, and upload your desired image. We will mail your new personalized card, which you can use immediately.

A RewardsPlus Checking account offers perks such as no monthly fees, free money orders, and discounts on safe deposit box rentals. It’s designed for those seeking added value without specific account usage requirements.

In contrast, the Income Checking account is tailored for members aiming to maximize their earnings through higher interest rates. However, to earn a higher yield and receive ATM fee rebates, members must meet certain criteria, such as making a minimum number of debit or credit card transactions and setting up direct deposits.

While both accounts provide valuable features like free online banking and mobile wallet compatibility, they cater to different preferences regarding rewards versus potential earnings through interest rates.

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Learn about the features, benefits, and functions of checking accounts.

¹Early direct deposit is available for checking members that set up direct deposit with their employer or other payer to receive electronic deposits of regular periodic payments (such as salary, pension, or government benefits). Early direct deposits may be available to you up to 3 days earlier, however, we are dependent on the timing of your payer’s payment and therefore you may not always see your direct deposits arrive early.