Happy Holidays from Columbia Credit Union President & CEO Lindsey Salvestrin

Watch our President and CEO Lindsey Salvestrin deliver a holiday message thanking our members for a wonderful year.

A checking account is the foundation of everyday banking, but with so many options and features, it’s important to find the right fit for your needs. At Columbia Credit Union, we’re here to provide helpful insights, practical tips, and expert guidance to help you manage your money with confidence. Whether you’re looking for ways to simplify transactions, maximize rewards, or improve financial habits, our blog offers the resources you need to make informed decisions and get the most out of your checking account.

Watch our President and CEO Lindsey Salvestrin deliver a holiday message thanking our members for a wonderful year.

By integrating the right financial products into your daily life, you can build a solid foundation that reduces stress, increases confidence, and puts you in control of your future.

Columbia Credit Union offers products and services designed to help members manage their money and achieve financial wellness.

View all of your online subscriptions and websites with your card on file in one place with Card Manager in Digital Banking and the Columbia CU app.

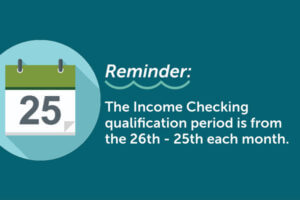

Meet each of the Income Checking qualifications during the period of the 26th of the prior month to the 25th of the current month.