Join Us

JOIN US

Members are adding up the savings.

Checking that pays you back.

Savings that grow faster.

Auto loans that free up your budget.

JOIN US

Members are adding up the savings.

+ Checking that pays you back.

+ Savings that grow faster.

+ Auto loans that free up your budget.

INCOME CHECKING

Earn a leading APY with Income Checking.

Each month, earn 4.50% APY¹ on balances up to $25,000 and receive up to $25 in nationwide ATM fee rebates when 3 easy steps are completed during that month’s Requirements Period (26th of the prior month – 25th of the current month):

- Make at least 15 purchases using a combination of your Columbia CU debit card(s) and credit card(s)

- Have one direct deposit of at least $500 into your Income Checking

- Enroll in e-statements

INCOME CHECKING

Earn a leading APY with Income Checking.

Each month, earn 4.50% APY¹ on balances up to $25,000 and receive up to $25 in nationwide ATM fee rebates when 3 easy steps are completed during that month’s Requirements Period (26th of the prior month – 25th of the current month):

- Make at least 15 purchases using a combination of your Columbia CU debit card(s) and credit card(s)

- Have one direct deposit of at least $500 into your Income Checking

- Enroll in e-statements

CREDIT UNIONS

Join the credit union movement.

Lindsey Salvestrin, our President & CEO, joined branch leader Julie Bocanegra on Hello Rose City to discuss the credit union movement and all the benefits of being a member at a place that puts members first:

- How money stays in the community

- Why credit unions can offer better rates

- What local service brings to members

CREDIT UNIONS

Join the credit union movement.

Lindsey Salvestrin, our President & CEO, joined branch leader Julie Bocanegra on Hello Rose City to discuss the credit union movement and all the benefits of being a member at a place that puts members first:

- How money stays in the community

- Why credit unions can offer better rates

- What local service brings to members

★★★★★

"I love my bank. Columbia CU makes it super easy to complete all my banking needs! Come join us."

- Angie G.

CERTIFICATE ACCOUNTS

Plant it. Leave it. Watch it grow.

Plant some funds and watch savings interest grow faster than a savings account.

- Earn high dividends on your money by planting them in a Certificate Account

- Minimum balance as low as $500

- Automatically renewable at then-current market rates

CERTIFICATE ACCOUNTS

Plant it. Leave it. Watch it grow.

Plant some funds and watch savings interest grow faster than a savings account.

- Earn high dividends on your money by planting them in a Certificate Account

- Minimum balance as low as $500

- Automatically renewable at then-current market rates

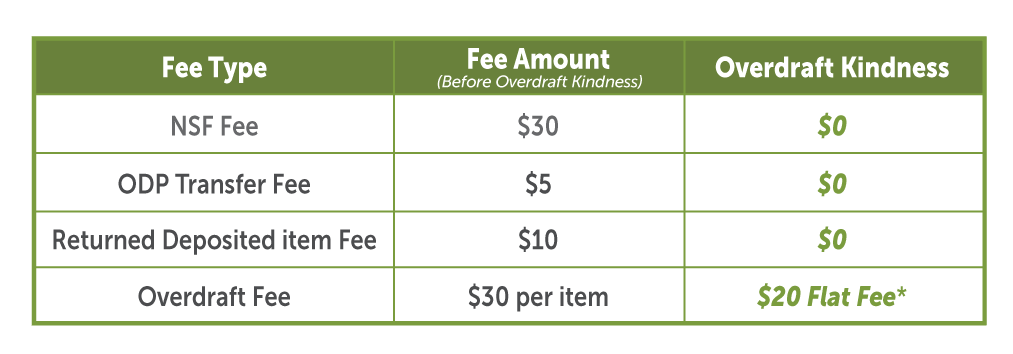

Extending a Little Kindness

Overdrafts happen. Charging more of what you already don’t have doesn’t help anyone. That’s why our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. In line with our core value of financial wellness, we absorb the burden of operating fees typically passed on to members when an account goes negative, while offering an opportunity to avoid a one-time fee if an account is brought back positive by the end of the day.

*No Overdraft Fee if, as of our day-end processing, the day’s withdrawal(s) don’t overdraw (or further overdraw) the current balance by more than $20.

No Overdraft Fee if deposit(s) or transfer(s) are made by 6:30 pm on the same day of the overdraft(s) to bring the current balance to at least $20 or less overdrawn.

BUSINESS BANKING

We're open for business! Let's grow yours.

Find flexible small business loans, personalized service, and smart banking solutions to help your business grow—whether you’re just starting out or starting to scale up.

We’ll handle the banking. You handle the business.

BUSINESS BANKING

We're open for business! Let's grow yours.

Find flexible small business loans, personalized service, and smart banking solutions to help your business grow—whether you’re just starting out or starting to scale up.

We’ll handle the banking. You handle the business.

MAKING LIFE BETTER

Meet Lindsey Salvestrin

After working her way up in the organization, Lindsey now heads the area’s largest financial institution. Watch the video to learn how Columbia Credit Union puts people first.

MAKING LIFE BETTER

Meet Lindsey Salvestrin

After working her way up in the organization, Lindsey now heads the area’s largest financial institution. Watch the video to learn how Columbia Credit Union puts people first.

"Making life better is more than a slogan—it’s who we are."

Lindsey Salvestrin, Columbia CU President & CEO

"Making life better is more than a slogan—it’s who we are."

Lindsey Salvestrin, Columbia CU President & CEO

★★★★★

"Awesome people who work here. Never had a better experience. So glad I switched to a credit union. The tellers actually get to know you and who you are, unlike big banks that just see you as a number and not a human being. Thank you Columbia CU."

- Kenny B.

Join the Best

Years in a Row

0

Columbia Credit Union has been voted the Best of Clark County for 17 years in a row.

Stop by a Branch

Local Branches

0

With 14 branch locations, we’re never far away. Swing by your local branch today!

Growing Together

Raised for community organizations

$

0

M

Being a good corporate citizen is an ongoing responsibility. Our vision of giving involves more than just writing a check.

Join the Best

Years in a Row

0

Columbia Credit Union has been voted the Best of Clark County for 17 years in a row.

Stop by a Branch

Local Branches

0

With 14 branch locations, we’re never far away. Swing by your local branch today!

Growing Together

Raised for community organizations

$

0

M

Being a good corporate citizen is an ongoing responsibility. Our vision of giving involves more than just writing a check.

REDUCED AUTO RATES

Take 1.25% APR off your existing auto loan rate.

We want to put you in the driver’s seat of your car loan. Find great rates as low as 5.24% APR2, or take 1.25% APR off your existing rate from another lender on any year vehicle down to our floor of 4.99% APR when you refinance from another lender and set up automatic payments from your Columbia CU checking account.

Columbia Credit Union members can save $1,425 on average per year³ when they refinance their auto loan!

REDUCED AUTO RATES

Take 1.25% APR off your existing auto loan rate.

We want to put you in the driver’s seat of your car loan. Find great rates as low as 5.24% APR2, or take 1.25% APR off your existing rate from another lender on any year vehicle down to our floor of 4.99% APR when you refinance from another lender and set up automatic payments from your Columbia CU checking account.

Columbia Credit Union members can save $1,425 on average per year³ when they refinance their auto loan!

SIGNATURE CASHPLUS VISA®

Save all year with your credit card.

Put our cash back credit card to work on everything from everyday essentials to unique local experiences.

- Unlimited, automatic cash back: From the grocery store to the gas station, we’ll reward every dollar spent with cash back in your account.

- Introductory bonus cash offer: Get $200 after making $3,000 in purchases in the first 90 days

- Our most generous rewards: Earn 1.25 points back per $1 spent.

- Stay or play: Enjoy hotel, car, and golf discounts with your VISA® cash back credit card.

- No international service fees: Plus many more benefits for every cardholder!

- 24/7 card support: Contact VISA® customer service for assistance anytime, anywhere.

- Anti-fraud features: Get 24/7 fraud protection, alerts, and support.

SIGNATURE CASHPLUS VISA®

Save all year with your credit card.

Put our cash back credit card to work on everything from everyday essentials to unique local experiences.

- Unlimited, automatic cash back: From the grocery store to the gas station, we’ll reward every dollar spent with cash back in your account.

- Introductory bonus cash offer: Get $200 after making $3,000 in purchases in the first 90 days

- Our most generous rewards: Earn 1.25 points back per $1 spent.

- Stay or play: Enjoy hotel, car, and golf discounts with your VISA® cash back credit card.

- No international service fees: Plus many more benefits for every cardholder!

- 24/7 card support: Contact VISA® customer service for assistance anytime, anywhere.

- Anti-fraud features: Get 24/7 fraud protection, alerts, and support.

HOME EQUITY LINE OF CREDIT (HELOC)

Borrow what you need, when you need it.

Borrow against the equity in your home as often as needed during the draw period. Repay the borrowed money with fixed monthly payments after the draw period ends.

- Revolving Line of Credit: Borrow up to 100% of your home’s equity as often as needed during the draw period. Repay it, and then borrow again.

- Make Interest-Only Payments: Pay interest only on what you borrow during the draw period, which keeps payments lower early on.

- Flexible Borrowing: Ideal for ongoing or unexpected expenses — like home repairs, debt consolidation, or emergencies.

- Low Rates: HELOCs typically have lower rates than other financing options, like credit cards or personal loans.

Ready to remodel your kitchen at your own pace? Get started with a HELOC today to access flexible funding with low rates and the freedom to borrow when needed.

Not sure which home equity option is best for your needs? Compare the key features of Home Equity Loans and HELOCs here.

HOME EQUITY LINE OF CREDIT (HELOC)

Borrow what you need, when you need it.

Borrow against the equity in your home as often as needed during the draw period. Repay the borrowed money with fixed monthly payments after the draw period ends.

- Revolving Line of Credit: Borrow up to 100% of your home’s equity as often as needed during the draw period. Repay it, and then borrow again.

- Make Interest-Only Payments: Pay interest only on what you borrow during the draw period, which keeps payments lower early on.

- Flexible Borrowing: Ideal for ongoing or unexpected expenses — like home repairs, debt consolidation, or emergencies.

- Low Rates: HELOCs typically have lower rates than other financing options, like credit cards or personal loans.

Ready to remodel your kitchen at your own pace? Get started with a HELOC today to access flexible funding with low rates and the freedom to borrow when needed.

Not sure which home equity option is best for your needs? Compare the key features of Home Equity Loans and HELOCs here.

Don't just take it from us.

Best of Clark County Award

2008-2025

The Columbian

Corporate Philanthropy Award

2017-2025

Portland Business Journal

Best in Business Award

2013-2024

Vancouver Business Journal

MAKING LIFE BETTER

Meet Susan Peake

Susan Peake is a cheerful regular at the Washougal branch. Watch the video to learn a bit more about Susan’s story with Columbia Credit Union.

MAKING LIFE BETTER

Meet Susan Peake

Susan Peake is a cheerful regular at the Washougal branch. Watch the video to learn a bit more about Susan’s story with Columbia Credit Union.

WHAT LOCAL MEMBERS ARE SAYING

"They're all about changing their members' lives, and their communities' lives. And that's what they're going to do for you."

Susan Peake, Columbia CU Member

WHAT LOCAL MEMBERS ARE SAYING

"They're all about changing their members' lives, and their communities' lives. And that's what they're going to do for you."

Susan Peake, Columbia CU Member

Become a member.

Columbia Credit Union membership is open to individuals and businesses in Washington State and in the Oregon communities of Clackamas, Marion, Multnomah, and Washington Counties (and to the families of eligible individuals).

¹APY=Annual Percentage Yield is accurate as of January 1, 2026, and can change at any time without notice. When qualifications are met, the Rewards Dividend Rate is calculated and accrued daily on ending balances of $25,000 or less. Dividends are paid and compounded monthly. The advertised Rewards APY assumes your balance including the prior months’ dividends, is $25,000 or less every day of every month during the APY’s annual look-ahead timeframe. Minimum to open is $1. Requirements Period: (26th of the prior month – 25th of the current month). To earn Rewards APY and/or ATM fee rebates you must complete these three Requirements during the month’s Requirements Period: 1) Be enrolled in e-Statements; 2) Have one direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

²APR=Annual Percentage Rate and is accurate as of January 30, 2026. APRs range from 5.24% to 13.99%. The APR you qualify for is based on repayment period, your vehicle’s value, year and mileage, and your credit qualifications including residential status, credit and employment history. Payment example: If you borrow $20,000 for 60 months at 5.24% APR, your monthly payment would be $379.63.

If you’re refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying APR or; b) up to 1.00% APR off your current lender’s APR down to our floor of 4.99% APR. Lowest APRs include Checking Relationship Plan discount which provides a qualifying rate discount of 0.25% APR for automatic loan payments from Columbia CU checking. Within 60 days of loan closing, automatic payments can be set up via an automatic transfer from your Columbia CU consumer checking account to your loan with the assistance of a Columbia CU representative via phone or by visiting your local branch. Membership required to borrow. Columbia Credit Union may offer other rates in the future.

³The average savings is calculated based on the estimated total interest that members save annually, resulting from a lower interest rate and an extended repayment term of 1 year (based on average loans Columbia Credit Union funded in 2024). Your actual savings may be different depending on your individual circumstances. Refinance savings may result from a lower interest rate, longer term, or both. There is no guarantee of savings. Your actual savings, if any, may vary based on interest rates, the repayment term, the amount financed, and other factors.