Columbia Credit Union

COLUMBIA CREDIT UNION

Where you bank matters.

Columbia Credit Union is your local not-for-profit financial institution. Your money here flows right back into the community to offer lower loan rates, high-yield deposits, and widespread donation dollars.

LIMITED TIME SPECIAL OFFER

We just lowered our mortgage rate!

We’re making homeowning more affordable with a limited-time mortgage special! With our 3/6 ARM, we can give you more buying power or a better refinance deal that starts as low as 4.99% interest rate and 5.098% APR.* Enjoy a fixed rate for the first 3 years, followed by an adjustable rate that may increase or decrease every 6 months.

- Adjustable Rate Mortgage (ARM) with 3-year fixed rate

- Great for purchases or cash-out refinances

- Super-low rate from a place you can trust

When it comes to home lending, we’ve got you covered.

LIMITED TIME SPECIAL OFFER

We just lowered our mortgage rate!

We’re making homeowning more affordable with a limited-time mortgage special! With our 3/6 ARM, we can give you more buying power or a better refinance deal that starts as low as 4.99% interest rate and 5.098% APR.* Enjoy a fixed rate for the first 3 years, followed by an adjustable rate that may increase or decrease every 6 months.

- Adjustable Rate Mortgage (ARM) with 3-year fixed rate

- Great for purchases or cash-out refinances

- Super-low rate from a place you can trust

When it comes to home lending, we’ve got you covered.

INCOME CHECKING

Free checking that pays.

Make your money work harder for you with early direct deposits, ATM fee rebates, and earnings every month.

INCOME CHECKING

Free checking that pays.

Make your money work harder for you with early direct deposits, ATM fee rebates, and earnings every month.

VISA CREDIT CARDS

Credit cards are better from your credit union.

With low rates, high rewards, and global travel benefits—there’s a Columbia CU credit card for everyone.

VISA CREDIT CARDS

Credit cards are better from your credit union.

With low rates, high rewards, and global travel benefits—there’s a Columbia CU credit card for everyone.

OVERDRAFT KINDNESS

Overdrafts happen.

Our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. Account go negative? Avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30pm on the day of that overdraft.

OVERDRAFT KINDNESS

Overdrafts happen.

Our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. Account go negative? Avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30pm on the day of that overdraft.

MORTGAGE LENDING

Home loans made easy.

Whether you’re looking for your first home or planning your dream remodel, our local experts will help get you through the door.

MORTGAGE LENDING

Home loans made easy.

Whether you’re looking for your first home or planning your dream remodel, our local experts will help get you through the door.

BUSINESS BANKING

We're open for business! Let's grow yours.

Find flexible small business loans, personalized service, and smart banking solutions to help your business grow—whether you’re just starting out or starting to scale up.

We’ll handle the banking. You handle the business.

BUSINESS BANKING

We're open for business! Let's grow yours.

Find flexible small business loans, personalized service, and smart banking solutions to help your business grow—whether you’re just starting out or starting to scale up.

We’ll handle the banking. You handle the business.

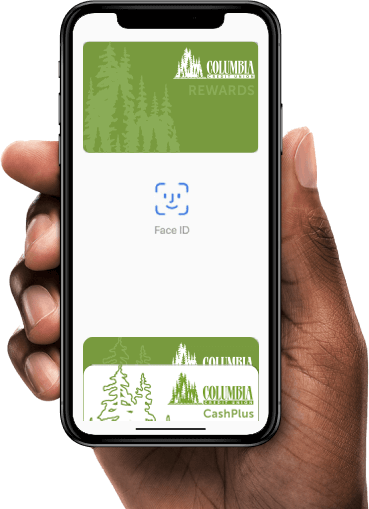

MOBILE WALLET

Pay without making contact.

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

- Secure transactions: Add your Columbia Credit Union card to your mobile wallet for secure payments.

- Contact-free shopping: Make purchases in stores and within apps without swiping your card or entering payment information.

- Protect your personal information: Merchants will never see your name, card numbers, or security codes.

- Easy setup: To start using Mobile Wallet, just add your Columbia CU debit or credit card to the Apple Pay, Google Pay, or Samsung Pay app on your device.

- Discover more digital services: Explore more ways Columbia Credit Union can simplify your life with our digital services.

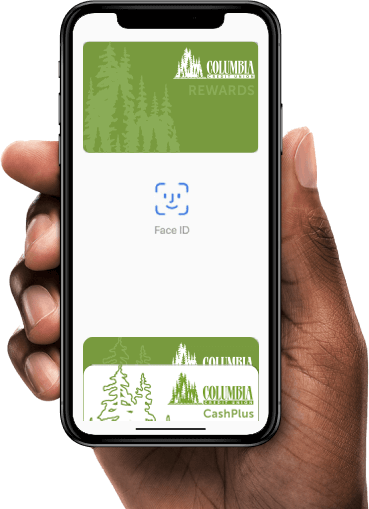

MOBILE WALLET

Pay without making contact.

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

- Secure transactions: Add your Columbia Credit Union card to your mobile wallet for secure payments.

- Contact-free shopping: Make purchases in stores and within apps without swiping your card or entering payment information.

- Protect your personal information: Merchants will never see your name, card numbers, or security codes.

- Easy setup: To start using Mobile Wallet, just add your Columbia CU debit or credit card to the Apple Pay, Google Pay, or Samsung Pay app on your device.

- Discover more digital services: Explore more ways Columbia Credit Union can simplify your life with our digital services.

$50 FOR YOU! $50 FOR THEM!

Refer a Friend for $50

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $50 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

$50 FOR YOU! $50 FOR THEM!

Refer a Friend for $50

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $50 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Don't just take it from us.

Best of Clark County Award

2008-2025

The Columbian

Corporate Philanthropy Award

2017-2025

Portland Business Journal

Best in Business Award

2013-2024

Vancouver Business Journal

*3/6 adjustable-rate mortgage (ARM): 4.99% interest rate is fixed for the first 3 years. Thereafter adjusts every 6 months based on the 6-month SOFR index plus a 3.00% margin. Rate and payment may increase subject to caps of 2% initial,1% periodic, and 5% lifetime. Maximum Interest Rate 9.99%.*Annual Percentage Rate (APR) 5.098%, accurate as of March 1st, 2026. Rates may vary based on creditworthiness. Offer available for a limited time and subject to change without notice. Applications must be submitted by May 31, 2026. Membership and credit approval are required.

¹APY=Annual Percentage Yield is accurate as of January 1, 2026, and can change at any time without notice. When qualifications are met, the Rewards Dividend Rate is calculated and accrued daily on ending balances of $25,000 or less. Dividends are paid and compounded monthly. The advertised Rewards APY assumes your balance including the prior months’ dividends, is $25,000 or less every day of every month during the APY’s annual look-ahead timeframe. Minimum to open is $1. Requirements Period: (26th of the prior month – 25th of the current month). To earn Rewards APY and/or ATM fee rebates you must complete these three Requirements during the month’s Requirements Period: 1) Be enrolled in e-Statements; 2) Have one direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

²APR=Annual Percentage Rate and is accurate as of January 30, 2026. APRs range from 5.24% to 13.99%. The APR you qualify for is based on repayment period, your vehicle’s value, year and mileage, and your credit qualifications including residential status, credit and employment history. Payment example: If you borrow $20,000 for 60 months at 5.24% APR, your monthly payment would be $379.63.

If you’re refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying APR or; b) up to 1.00% APR off your current lender’s APR down to our floor of 4.99% APR. Lowest APRs include Checking Relationship Plan discount which provides a qualifying rate discount of 0.25% APR for automatic loan payments from Columbia CU checking. Within 60 days of loan closing, automatic payments can be set up via an automatic transfer from your Columbia CU consumer checking account to your loan with the assistance of a Columbia CU representative via phone or by visiting your local branch. Membership required to borrow. Columbia Credit Union may offer other rates in the future.