Columbia Credit Union

COLUMBIA CREDIT UNION

Where you bank matters.

Columbia Credit Union is your local not-for-profit financial institution. Your money here flows right back into the community to offer lower loan rates, high-yield deposits, and widespread donation dollars.

MEMBER APPRECIATION MONTH: SWEEPSTAKES

$500 for 15 Swipes Sweepstakes

This October we’re giving you the chance to enter to win with your everyday purchases! Make 15 qualifying transactions of $5 or more with your debit card or credit card from October 1st – 31st to be automatically entered to win a $500 prize.

Two chances to win:

$500 for 15 debit card transactions

$500 for 15 credit card transactions

Enter to win by making 15 qualifying transactions with either card—or both for two entries! Swipe. Tap. Pay. Win.

MEMBER APPRECIATION MONTH: SWEEPSTAKES

$500 for 15 Swipes Sweepstakes

This October we’re giving you the chance to enter to win with your everyday purchases! Make 15 qualifying transactions of $5 or more with your debit card or credit card from October 1st – 31st to be automatically entered to win a $500 prize.

Two chances to win:

$500 for 15 debit card transactions

$500 for 15 credit card transactions

Enter to win by making 15 qualifying transactions with either card—or both for two entries! Swipe. Tap. Pay. Win.

MEMBER APPRECIATION MONTH: SPEND CHECKING OFFER

Get a $25 bonus when you open their first checking account.1

Spend Checking is a free account for kids up to age 18 with a parent or guardian co-account holder. Pick a custom-design debit card, get access to Online & Mobile Banking, and learn about your first spending account with budgeting tools, no overdrafts, and lower limits for ATM withdrawals.

Get a $25 Bonus when you:

- Open a Spend Checking and Savings account

- Enroll in Online Banking, e-Statements, and Fern.

Teach your kids how to earn with Fern!

Fern helps parents and kids build smart money habits together. With interactive tools and guidance, it’s the perfect way to turn everyday moments into lifelong lessons.

Get started today – this offer ends October 31, 2025!

MEMBER APPRECIATION MONTH: SPEND CHECKING OFFER

Get a $25 bonus when you open their first checking account.1

Spend Checking is a free account for kids up to age 18 with a parent or guardian co-account holder. Pick a custom-design debit card, get access to Online & Mobile Banking, and learn about your first spending account with budgeting tools, no overdrafts, and lower limits for ATM withdrawals.

Get a $25 Bonus when you:

- Open a Spend Checking and Savings account

- Enroll in Online Banking, e-Statements, and Fern.

Teach your kids how to earn with Fern!

Fern helps parents and kids build smart money habits together. With interactive tools and guidance, it’s the perfect way to turn everyday moments into lifelong lessons.

Get started today – this offer ends October 31, 2025!

INCOME CHECKING

Free checking that pays.

Make your money work harder for you with early direct deposits, ATM fee rebates, and earnings every month.

INCOME CHECKING

Free checking that pays.

Make your money work harder for you with early direct deposits, ATM fee rebates, and earnings every month.

VISA CREDIT CARDS

Credit cards are better from your credit union.

With low rates, high rewards, and global travel benefits—there’s a Columbia CU credit card for everyone.

VISA CREDIT CARDS

Credit cards are better from your credit union.

With low rates, high rewards, and global travel benefits—there’s a Columbia CU credit card for everyone.

OVERDRAFT KINDNESS

Overdrafts happen.

Our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. Account go negative? Avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30pm on the day of that overdraft.

OVERDRAFT KINDNESS

Overdrafts happen.

Our Overdraft Kindness eliminates fees to help smooth the path when finances get rocky. Account go negative? Avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30pm on the day of that overdraft.

MORTGAGE LENDING

Home loans made easy.

Whether you’re looking for your first home or planning your dream remodel, our local experts will help get you through the door.

MORTGAGE LENDING

Home loans made easy.

Whether you’re looking for your first home or planning your dream remodel, our local experts will help get you through the door.

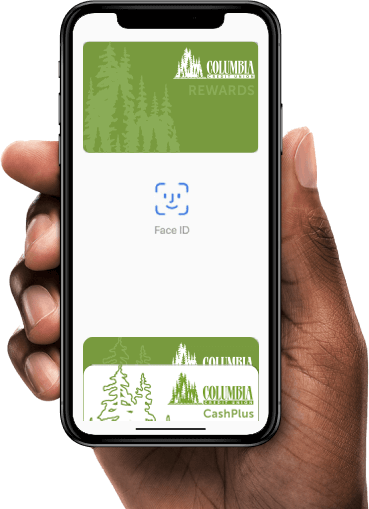

MOBILE WALLET

Pay without making contact.

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

- Secure transactions: Add your Columbia Credit Union card to your mobile wallet for secure payments.

- Contact-free shopping: Make purchases in stores and within apps without swiping your card or entering payment information.

- Protect your personal information: Merchants will never see your name, card numbers, or security codes.

- Easy setup: To start using Mobile Wallet, just add your Columbia CU debit or credit card to the Apple Pay, Google Pay, or Samsung Pay app on your device.

- Discover more digital services: Explore more ways Columbia Credit Union can simplify your life with our digital services.

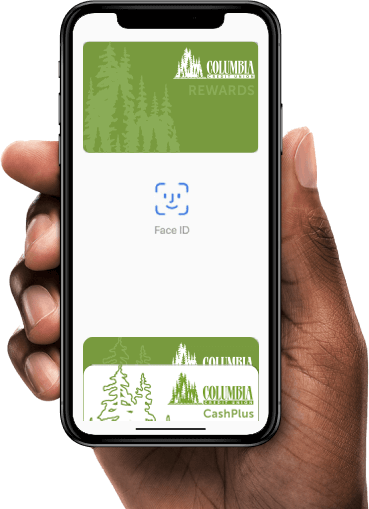

MOBILE WALLET

Pay without making contact.

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

- Secure transactions: Add your Columbia Credit Union card to your mobile wallet for secure payments.

- Contact-free shopping: Make purchases in stores and within apps without swiping your card or entering payment information.

- Protect your personal information: Merchants will never see your name, card numbers, or security codes.

- Easy setup: To start using Mobile Wallet, just add your Columbia CU debit or credit card to the Apple Pay, Google Pay, or Samsung Pay app on your device.

- Discover more digital services: Explore more ways Columbia Credit Union can simplify your life with our digital services.

WHAT LOCAL MEMBERS ARE SAYING

"I admire the values that Columbia Credit Union portrays. They are in the community everywhere."

Jamie Young, Columbia CU Member

WHAT LOCAL MEMBERS ARE SAYING

"I admire the values that Columbia Credit Union portrays. They are in the community everywhere."

Jamie Young, Columbia CU Member

REFER A FRIEND BONUS

Refer a Friend for $121

We’re celebrating our 121,000+ members with a $121 referral boost payout through December, 2025! That means you can BOTH earn $121 when you refer your friends and family to join. The more you refer, the more you can earn!

REFER A FRIEND BONUS

Refer a Friend for $121

We’re celebrating our 121,000+ members with a $121 referral boost payout through December, 2025! That means you can BOTH earn $121 when you refer your friends and family to join. The more you refer, the more you can earn!

Don't just take it from us.

Best of Clark County Award

2008-2025

The Columbian

Corporate Philanthropy Award

2017-2024

Portland Business Journal

Best in Business Award

2013-2024

Vancouver Business Journal

¹Limited Time Offer. The promotional period runs from October 1, 2025 through October 31, 2025. To qualify for the Spend Checking account offer, you must open a new account between October 1 and October 31, 2025, with a minimum deposit of $1.00 for your child up to age 18. Account owner must be a minor with a parent or guardian as a joint owner on the account. This offer is available only to new Spend Checking accounts; the applicant must not have held a Columbia CU checking account within the past 12 months. To earn the $25 bonus, the following requirements must be completed within 60 days of account opening: (a) open a new Spend Checking account and savings account, and (b) enroll in Online Banking, e-Statements, and Fern. All qualifications must be met before November 30, 2025, and the account must be in good standing with a balance greater than zero at the time the bonus is paid. The $25 bonus will be automatically deposited into the youth’s primary savings account by December 15, 2025 after all qualifications have been met. Only one cash bonus will be awarded per Social Security Number. Offer is subject to change without notice. Bonus may not be paid if promotion is retrieved from a deals website.

²APY=Annual Percentage Yield is accurate as of December 1, 2024, and can change at any time without notice. When qualifications are met, the Rewards Dividend Rate is calculated and accrued daily on ending balances of $25,000 or less. Dividends are paid and compounded monthly. The advertised Rewards APY assumes your balance including the prior months’ dividends, is $25,000 or less every day of every month during the APY’s annual look-ahead timeframe. Minimum to open is $1. Requirements Period: (26th of the prior month – 25th of the current month). To earn Rewards APY and/or ATM fee rebates you must complete these three Requirements during the month’s Requirements Period: 1) Be enrolled in e-Statements; 2) Have one direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

³APR=Annual Percentage Rate and is accurate as of September 15, 2025. APRs range from 5.49% to 13.99%. The APR you qualify for is based on repayment period, your vehicle’s value, year and mileage, and your credit qualifications including residential status, credit and employment history. Payment example: If you borrow $20,000 for 60 months at 5.49% APR, your monthly payment would be $381.93.

If you’re refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying APR or; b) up to 1.00% APR off your current lender’s APR down to our floor of 4.99% APR. Lowest APRs include Checking Relationship Plan discount which provides a qualifying rate discount of 0.25% APR for automatic loan payments from Columbia CU checking. Within 60 days of loan closing, automatic payments can be set up via an automatic transfer from your Columbia CU consumer checking account to your loan with the assistance of a Columbia CU representative via phone or by visiting your local branch. Membership required to borrow. Columbia Credit Union may offer other rates in the future.