2026 Annual Updates: Social Security, Medicare, and ACA

Revisit our webinar with retirement expert Rhian Horgan, diving into the latest updates to ensure you stay well-informed and ahead of the curve as you start 2026.

Find workshops for homebuying, retirement planning, and more.

Quick and easy video tutorials for digital services and more.

Fast lessons on financial topics, concepts, and strategies.

Your financial health is our priority, so we’ve partnered with the trusted national nonprofit GreenPath Financial Wellness to offer you free* financial counseling, guidance, and educational resources. GreenPath is here to support you in making decisions that make your life better, happier, and more satisfying.

GreenPath has more than 60 years of experience helping people build financial health and resiliency. Their NFCC and HUD-certified counselors explain your options to manage credit card debt, learn about personal finance, and come up with a plan to make your financial goals happen.

Your financial health is our priority, so we’ve partnered with the trusted national nonprofit GreenPath Financial Wellness to offer you free* financial counseling, guidance, and educational resources. GreenPath is here to support you in making decisions that make your life better, happier, and more satisfying.

GreenPath has more than 60 years of experience helping people build financial health and resiliency. Their NFCC and HUD-certified counselors explain your options to manage credit card debt, learn about personal finance, and come up with a plan to make your financial goals happen.

You have access to free, one-on-one financial counseling delivered by caring, certified experts. Understand your situation, learn about options, and make a plan to reach your goals.

If you have housing goals or concerns, GreenPath’s HUD-certified housing counselors can help. Take advantage of foreclosure prevention services, homebuyer counseling, rental counseling, and reverse mortgage counseling.

GreenPath can point you to resources to understand your options and next steps for student loans.

If you have high-interest credit card debt, a GreenPath Debt Management Plan may be able to help lower your interest rates so you can pay off debt faster while saving money.

Learn how to read your personal credit report, how a credit score is calculated, and how to build or improve your score.

Take advantage of free, monthly educational webinars, articles and online learning designed to strengthen your financial health.

You have access to free, one-on-one financial counseling delivered by caring, certified experts. Understand your situation, learn about options, and make a plan to reach your goals.

If you have high-interest credit card debt, a GreenPath Debt Management Plan may be able to help lower your interest rates so you can pay off debt faster while saving money.

If you have housing goals or concerns, GreenPath’s HUD-certified housing counselors can help. Take advantage of foreclosure prevention services, homebuyer counseling, rental counseling, and reverse mortgage counseling.

Learn how to read your personal credit report, how a credit score is calculated, and how to build or improve your score.

GreenPath can point you to resources to understand your options and next steps for student loans.

Take advantage of free, monthly educational webinars, articles and online learning designed to strengthen your financial health.

Call GreenPath today to connect with a kind, caring, NFCC-certified counselor – no appointment necessary. Make informed financial decisions and find your path to a bright financial future. It’s free, no-pressure, and 100% confidential.

Hours of Operation:

Monday-Thursday: 5:00 AM – 7:00 PM PST

Friday: 5:00 AM – 5:00 PM PST

Saturday: 6:00 AM – 10:00 AM PST

Call GreenPath today to connect with a kind, caring, NFCC-certified counselor – no appointment necessary. Make informed financial decisions and find your path to a bright financial future. It’s free, no-pressure, and 100% confidential.

Hours of Operation:

Monday-Thursday: 5:00 AM – 7:00 PM PST

Friday: 5:00 AM – 5:00 PM PST

Saturday: 6:00 AM – 10:00 AM PST

Revisit our webinar with retirement expert Rhian Horgan, diving into the latest updates to ensure you stay well-informed and ahead of the curve as you start 2026.

These five holiday budget strategies will help you enjoy a festive season without the financial headaches.

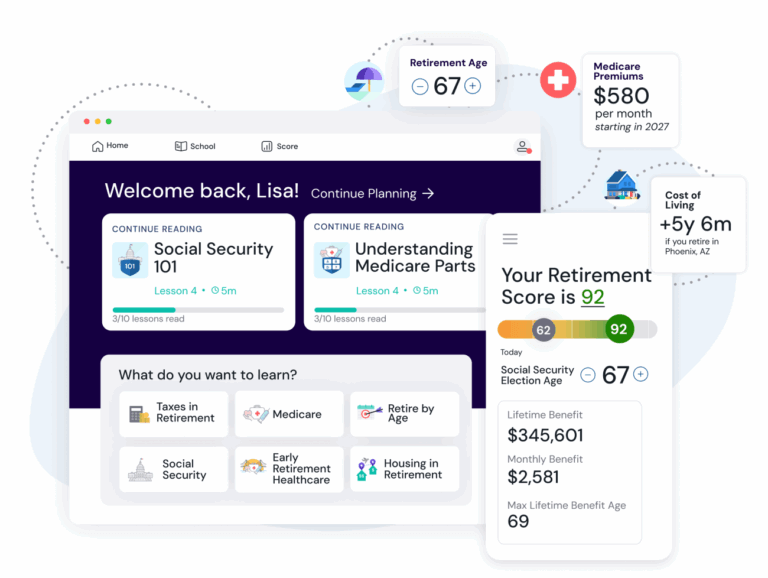

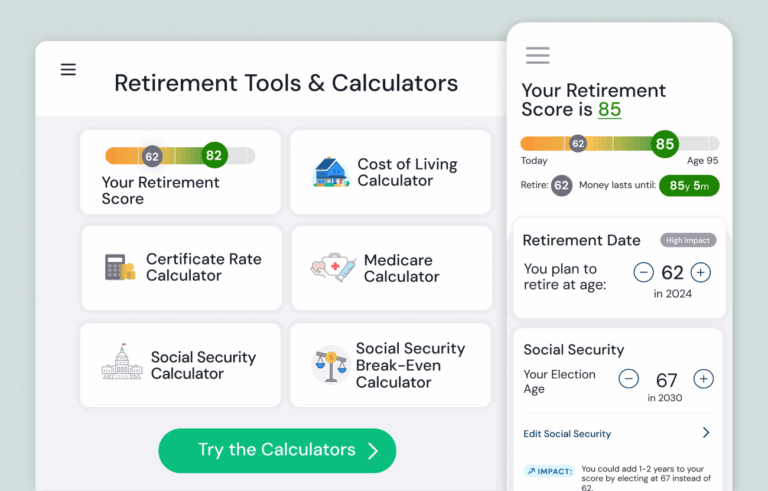

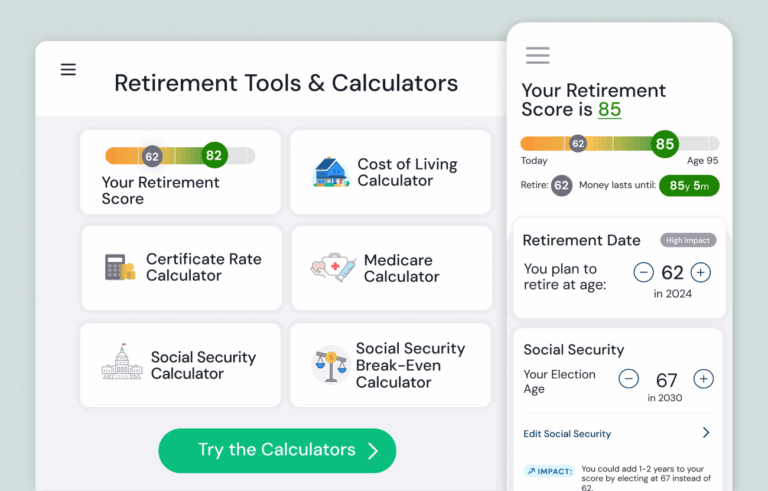

As a Columbia CU member, you get free access to easy-to-use tools and personalized resources to help you navigate retirement with financial confidence.

As a Columbia CU member, you get free access to easy-to-use tools and personalized resources to help you navigate retirement with financial confidence.

Adjust your inputs and make informed decisions on important retirement questions, like:

Adjust your inputs and make informed decisions on important retirement questions, like:

Learn just what you need to know—right when you need to know it—with concise and easy-to-understand courses from our experts on Social Security, Medicare, taxes, and other key retirement topics.

Learn just what you need to know—right when you need to know it—with concise and easy-to-understand courses from our experts on Social Security, Medicare, taxes, and other key retirement topics.

Activate your free Columbia CU Retirement Simplified account today.

Activate your free Columbia CU Retirement Simplified account today.

Learn how to be more financially prepared in the years ahead.

Learn how to manage your money and avoid financial dangers.

Learn more about what it takes for your small business to thrive.

Explore the benefits and costs of buying and owning a home.

Learn how you should prepare for an eventual retirement.

Understand the basics of some key financial concepts.

*General credit and debt counseling is free, but some of the more specialized services may have associated fees. A GreenPath counselor will explain those costs to you if you elect to utilize those services beyond your initial credit counseling session. GreenPath does not report information to the credit bureaus and will not share your information with anyone without your permission. GreenPath does ask you for permission to share information with Columbia Credit Union. If you say “no,” your name is kept confidential. If you begin a debt management program, GreenPath will obtain your consent before it proposes payment arrangements to your creditors.