HIGH-YIELD CHECKING

Make your money work harder

Put your hard-earned money to work for you. Our Income Checking account gives you better interest rates for faster growth.

Put your hard-earned money to work for you. Our Income Checking account gives you better interest rates for faster growth.

Put your hard-earned money to work for you. Our Income Checking account gives you better interest rates for faster growth.

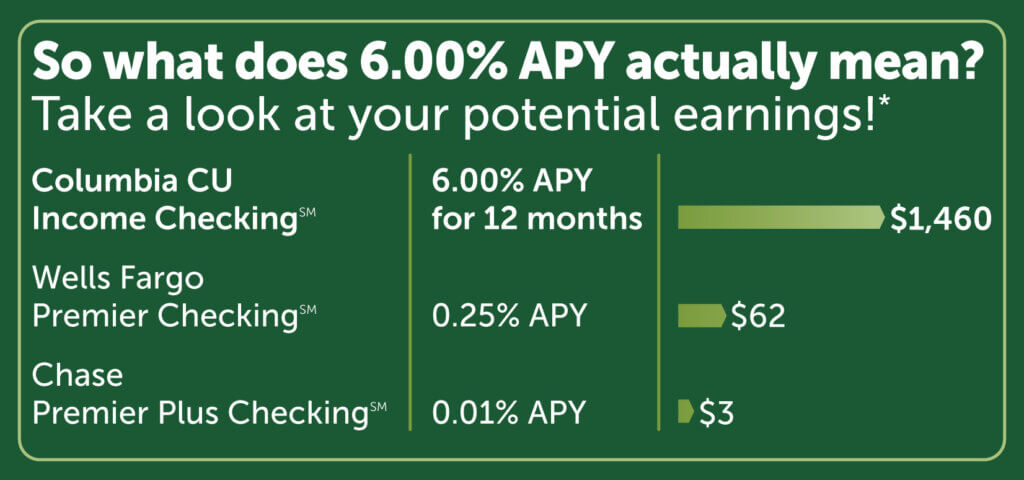

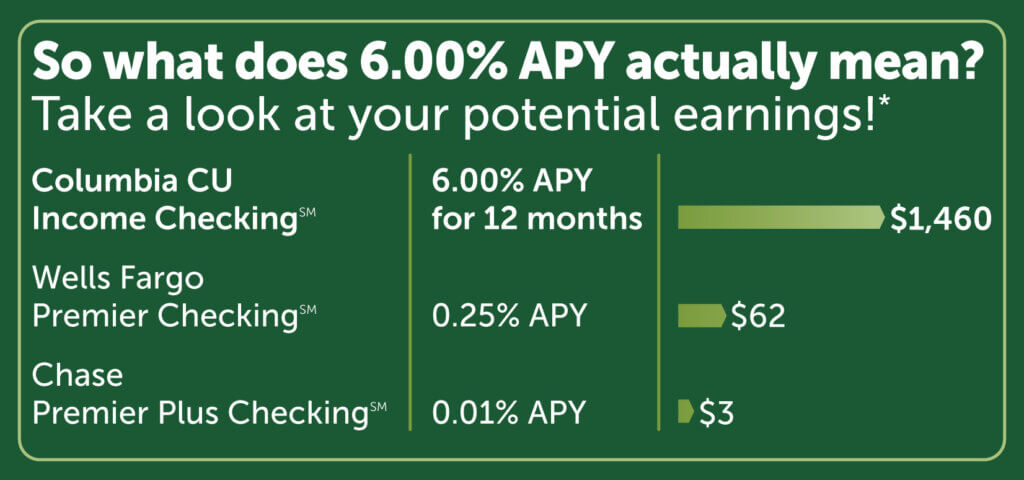

Earn high interest on your checking account with 6.00% APY¹ on balances up to $25,000 and get $25 in nationwide ATM fee rebates each month your free account qualifies in 3 easy steps:

Earn high interest on your checking account with 6.00% APY¹ on balances up to $25,000 and get $25 in nationwide ATM fee rebates each month your free account qualifies in 3 easy steps:

Open an account and enjoy our early direct deposit to get your money up to three days early.²

Open an account and enjoy our early direct deposit to get your money up to three days early.²

Enjoy greater interest rates than traditional checking accounts. The more you save, the more you earn!

Keep more of your money in your wallet thanks to no monthly or transaction fees.

Get $25 in nationwide ATM fee reimbursements every month your account qualifies.

Other high-yield checking account benefits include:

Other high-yield checking account benefits include:

Our Card Manager feature in Online & Mobile Banking helps secure your cards while you’re away from home.

★★★★★

Your debit card purchases are deducted from your account balance like any regular checking account. Additionally, 15 Income Checking debit card and Columbia CU credit card purchases each month help you qualify for the high interest.

The Income Checking account offers a high-interest rate of 6.00% annual percentage yield APY on balances up to $25,000. There are specific requirements to earn this rate and up to $25 in ATM fee rebates. You must make at least 15 purchases with your debit and credit cards, have a direct deposit of at least $500, and enroll in e-statements. This account has no monthly fees or minimum balance requirements.

The RewardsPlus Checking account provides different benefits. It includes perks like one free folio of checks per year, free unlimited money orders, and a discount on safe deposit box rental.

This rewards checking account does not have monthly fees or minimum balance requirements. It offers free online and mobile banking, a budgeting tool, and e-statements. The focus for the RewardsPlus account is on banking-related discounts and perks rather than a high-interest rate.

Yes, you can use your High-Yield Checking account for daily transactions. You have the ability to make purchases, pay bills, and withdraw cash. These accounts combine the flexibility of a checking account with the advantage of higher interest rates.

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Learn about the features, benefits, and functions of checking accounts.

1APY=Annual Percentage Yield and is accurate as of July 10, 2023 and can change at any time without notice. Minimum to open is $1. To earn Rewards APY, you must meet each of the following Requirements during the period of the 26th of the prior month to the 25th of the current month: 1) Enrolled in e-Statements by 11:59 p.m. PT; 2) Have a direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: A posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

2Early direct deposit is available for checking members that set up direct deposit with their employer or other payer to receive electronic deposits of regular periodic payments (such as salary, pension, or government benefits). Early direct deposits may be available to you up to 3 days earlier, however, we are dependent on the timing of your payer’s payment and therefore you may not always see your direct deposits arrive early.